neurbooks

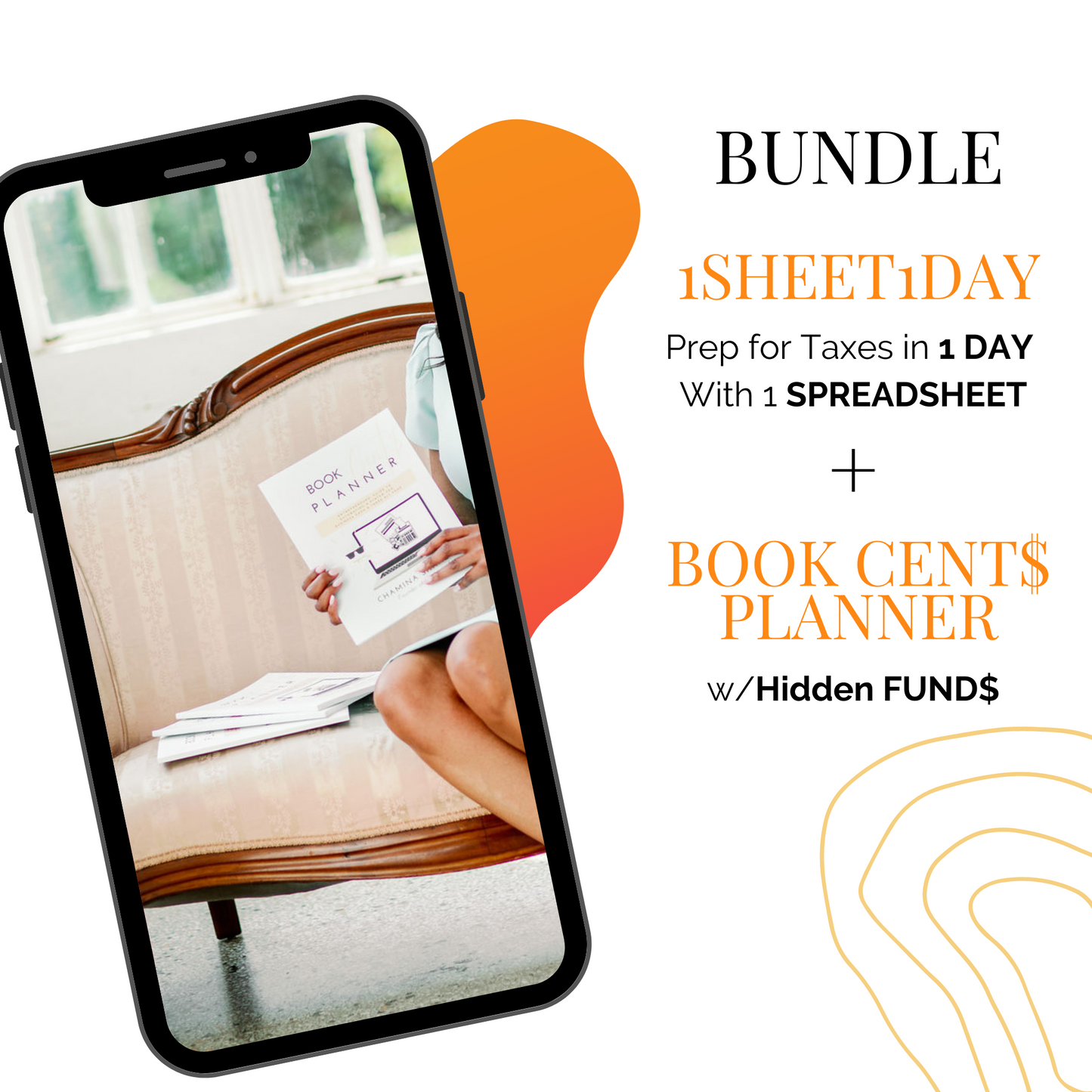

(Bundle) Book Cents Planner + 1Sheet1DAY

Couldn't load pickup availability

BOOK CENT$ PLANNER (W/HIDDEN FUNDS) + 1SHEET1DAY TRAINING

BOOK CENT$ PLANNER (W/HIDDEN FUNDS)

The Entrepreneurs Guide to Saving on Taxes All Year Long + How to Prep for Taxes in 1 DAY

Join the hundreds of entrepreneurs who have identified $10k in additional tax write-offs.

This is your guide to Productive Tax Planning made easy.

Implement a clear system that will guide your business through the tough obstacles of tax paperwork with the Book Cent$ Planner. Keep your company on track throughout the year, maximize your business finances and take advantage of effective methods with great results. The Book Cent$ Planner is perfect for the successful entrepreneur who wants a structured system in place without the need of a regular accountant.

BONUS FEATURE:

With your purchase of Book cents, you gain a bonus list of the most overlooked tax deductions. HIDDEN FUNDS is a list of the 50 most missed tax deductions that entrepreneurs don't realize are tax deductible, especially when transitioning as a boss. You can not afford to want to miss out on another tax write off .

Use this list as a guide to help you unlock hidden funds through BAE’S prior to filing your tax return. Avoid overpayments, filing for extensions. Whether you are the ultimate side hustler, a new entrepreneur or a vet in the tax game, HIDDEN FUNDS is your solution to all your tax season concerns.

1Sheet1DAY Training

This video training will show you the exact steps needed to prepare for your taxes in 1Day.

This training is for entrepreneurs---

- who did not keep track of their expenses or revenue throughout the year

- who mix personal and business transactions into one bank account

- who are just getting started and are not quite ready to hire a bookkeeper

- who have a home office and use their personal account for home purchases, utilities, and upkeep or use personal account to track autos used in business

If you are overwhelmed by taxes and feel like your expenses (and/or revenue) are all over the place, this training is for YOU!

This training teaches you how to easily extract only the transactions you need especially if you use one bank account for personal expenses & business transactions.

Share